Happy Holidays everybody!

First of all, if you were directed here from twitter, I want to let you know that I try my very best to read your tweets. You post a lot (A LOT!) of great information and news (you're where I'd say I get about 40% of my news.) , and I DO appreciate your dedication and I hope you find my posts as interesting as I find yours.

Today I want to share my thoughts on where we will be a year from now (in the vein of Doug Kass):

Increased regulation will stifle earnings growth for financials, and their stocks will be reduced to dividend paying, lending utilities.

Dollar value fluctuates but ultimately ends up around where it is today.

Ford Motors will emerge as the dominant automotive company in the US.

Interest rates rise earlier than expected.

Jobs recover! (maybe wishful thinking, but hey! it's the holidays!)

Afghanistan will be a mess.

Crude will cost $90 per barrel.

25% of movies are in 3D, making the theaters more fasionable again.

New home sales do not recover at a sufficient pace.

Provided we're in the right place, we'll have another great year in the market.

I'm willing to defend my positions! ;) and I'm always ready to hear other opinions.

What do you think? How full is the glass for you next year?

Comment or email me at sambarad@gmail.com

-Samba

Note: Starting next year, I will be posting my top 3 positions, my analysis, and any changes.

Wednesday, December 23, 2009

Wednesday, December 9, 2009

Selling Puts to Acquire Stock

Have you ever found yourself saying, "Man I would pick that stock up in an instant, if only it was just a couple points lower." We know that small differences in price can greatly impact your compounded earnings over the course of years. We should always buy stocks at the prices that we dictate. Long term limit orders are the most commonly used way to acquire stock at the price we want (and I hope you use limit orders for EVERY trade you make).

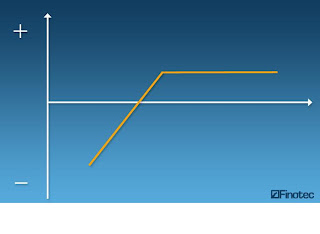

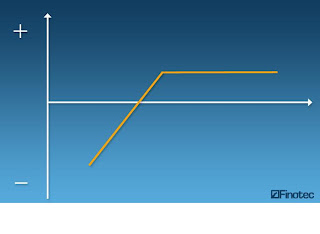

I want to talk about another widely used conservative strategy; that is, the use of puts to buy stock. When you sell a put, you are essentially agreeing to buy 100 shares of a specified stock at a specified price (usually, and for this meathod always, below its current price). You keep the premium you get for selling the option no matter what. Keep in mind, that's the max amount you can recieve. If the underlying goes up a hundred points, you still only keep whatever you got for the premium. On the other hand, you are liable to participate in substantial losses, should the stock price decrease substantially. This however, is the same risk you accept if you were to buy the stock any other way, except that you are protected somewhat by the option premium that you recieved when you sold the put.

Here we see profits and losses on the y-axis and stock prices ascending from left to right on the x-axis.

There are many advantages to this strategy over the use of limit orders. First and foremost, if the stock does go up or remain flat, you keep the premium. A limit order gets you nothing. Second, put options have expiration dates, which means you can have a better idea of when you will need the cash if and when you have to buy the stock. After all, anything can happen. If your limit order gets touched, you better have the cash ready. With a put, even if it gets to the strike price before expiration, there's no guarantee the puts will be exercised, and you will generally have days to muster up the cash because put buyers don't make a profit until the stock goes below the strike price. Usually, you only have to keep 20% of the strike price in cash to satisfy your brokerage. With limit orders, it's good to have 100% of the cash ready (so you don't unexpectedly go on margin), although that is by no means a requirement.

When implementing this strategy just remember that you are intending to buy a depreciated security. If you're selling puts just to increase cash flow, you better be absolutely certain that that thing isn't going to get exercised. Make sure that you are comfortable owning a stock that has depreciated. Remember that premiums are adjusted for volatility. More volatile stocks have higher premiums, and therefore a higher risk of painful depreciation. Also, remember that there was a reason you wanted to buy the stock lower for a reason. if the stock goes up, let it -unless the company has fundamentally changed.

If things are going REALLY badly, maybe on unexpected news, you can always close out your position, buy buying back your put.

I feel this strategy is best used in portfolios seeking income. If you want a certain dividend yield, and are waiting for the stock price to drop so you can get that yield, this is a perfect strategy to acquire income in the meantime. Dividend stocks generally have lower volatility and therefore have lower premiums, but if your objective is income, the lower premiums should still fulfill your objectives.

Good Luck,

-Samba

I want to talk about another widely used conservative strategy; that is, the use of puts to buy stock. When you sell a put, you are essentially agreeing to buy 100 shares of a specified stock at a specified price (usually, and for this meathod always, below its current price). You keep the premium you get for selling the option no matter what. Keep in mind, that's the max amount you can recieve. If the underlying goes up a hundred points, you still only keep whatever you got for the premium. On the other hand, you are liable to participate in substantial losses, should the stock price decrease substantially. This however, is the same risk you accept if you were to buy the stock any other way, except that you are protected somewhat by the option premium that you recieved when you sold the put.

Here we see profits and losses on the y-axis and stock prices ascending from left to right on the x-axis.

There are many advantages to this strategy over the use of limit orders. First and foremost, if the stock does go up or remain flat, you keep the premium. A limit order gets you nothing. Second, put options have expiration dates, which means you can have a better idea of when you will need the cash if and when you have to buy the stock. After all, anything can happen. If your limit order gets touched, you better have the cash ready. With a put, even if it gets to the strike price before expiration, there's no guarantee the puts will be exercised, and you will generally have days to muster up the cash because put buyers don't make a profit until the stock goes below the strike price. Usually, you only have to keep 20% of the strike price in cash to satisfy your brokerage. With limit orders, it's good to have 100% of the cash ready (so you don't unexpectedly go on margin), although that is by no means a requirement.

When implementing this strategy just remember that you are intending to buy a depreciated security. If you're selling puts just to increase cash flow, you better be absolutely certain that that thing isn't going to get exercised. Make sure that you are comfortable owning a stock that has depreciated. Remember that premiums are adjusted for volatility. More volatile stocks have higher premiums, and therefore a higher risk of painful depreciation. Also, remember that there was a reason you wanted to buy the stock lower for a reason. if the stock goes up, let it -unless the company has fundamentally changed.

If things are going REALLY badly, maybe on unexpected news, you can always close out your position, buy buying back your put.

I feel this strategy is best used in portfolios seeking income. If you want a certain dividend yield, and are waiting for the stock price to drop so you can get that yield, this is a perfect strategy to acquire income in the meantime. Dividend stocks generally have lower volatility and therefore have lower premiums, but if your objective is income, the lower premiums should still fulfill your objectives.

Good Luck,

-Samba

Wednesday, December 2, 2009

Bullish on Boeing

Hello hello. I want to take a closer look at the technicals for The Boeing Company (Public, NYSE:BA). I think that the fundamentals have finally justified what the technicals are telling me. Boeing has historically been a good play durring war time, and with Obama committing another 30,000 troops to Afghanistan, it looks like we're going to be there for a while. Also, there is always that 787 Dreamliner to look forward to, which is Boeings highly anticipated new plane model. With each set back and delay, the price of the stock goes down. It would be good to note however, that the stock has been reacting less and less with each delay. Let's look at the chart.

We can see a clear ascending accumulation triangle (which shouldn't be confused with the bearish ascending wedge pattern which is usually followed by a reversal). Recently, the stock price experienced an almost EXACTLY 10% measured move downward. Again, this usually marks a strong bullish upward continuation of the primary trend. I've been following this stock for a while, but the fundamentals never made it appealing enough. With the new troop surge, and a chart that screams buy, I have to recommend that you take a good look at Boeing.

Good Luck,

Samba

We can see a clear ascending accumulation triangle (which shouldn't be confused with the bearish ascending wedge pattern which is usually followed by a reversal). Recently, the stock price experienced an almost EXACTLY 10% measured move downward. Again, this usually marks a strong bullish upward continuation of the primary trend. I've been following this stock for a while, but the fundamentals never made it appealing enough. With the new troop surge, and a chart that screams buy, I have to recommend that you take a good look at Boeing.

Good Luck,

Samba

Wednesday, November 18, 2009

Results From My Future Price Calculator: MSFT, JWN, KO, CAT, IBM

Last night, I decided to write a simple program that would calculate a stock's past EPS growth rate, and take into account current EPS, average P/E, and some other fields, and spit out an apoximated rate of return and a price that would represent the stocks dollar value a decade from now.

I'd been doing the calculation the old fashioned way, and finally decided to expedite the proecess with a program. Generally, we like stocks that can give us above a 14% annual compounded rate of return not including dividends. Here are some of the results:

Microsoft Corporation (Public, NASDAQ:MSFT)

year 1.........EPS: 1.74

year 2.........EPS: 1.97

year 3.........EPS: 2.22

year 4.........EPS: 2.51

year 5.........EPS: 2.84

year 6.........EPS: 3.21

year 7.........EPS: 3.62

year 8.........EPS: 4.09

year 9.........EPS: 4.63

year 10........EPS: 5.23

Estimated price a decade from now given past growth rate: $102

The estimated annual rate of return (no dividends) compounded is 13.0%

Nordstrom, Inc. (Public, NYSE:JWN)

year 1.........EPS: 1.81

year 2.........EPS: 2.12

year 3.........EPS: 2.48

year 4.........EPS: 2.9

year 5.........EPS: 3.4

year 6.........EPS: 3.98

year 7.........EPS: 4.65

year 8.........EPS: 5.44

year 9.........EPS: 6.37

year 10........EPS: 7.45

Estimated price a decade from now given past growth rate: $156

The estimated annual rate of return (no dividends) compounded is 16.2%

The Coca-Cola Company (Public, NYSE:KO)

year 1.........EPS: 2.97

year 2.........EPS: 3.27

year 3.........EPS: 3.59

year 4.........EPS: 3.95

year 5.........EPS: 4.35

year 6.........EPS: 4.78

year 7.........EPS: 5.26

year 8.........EPS: 5.79

year 9.........EPS: 6.37

year 10........EPS: 7.0

Estimated price a decade from now given past growth rate: $119

The estimated annual rate of return (no dividends) compounded is 7.7%

Caterpillar Inc. (Public, NYSE:CAT)

year 1.........EPS: 2.41

year 2.........EPS: 2.72

year 3.........EPS: 3.07

year 4.........EPS: 3.47

year 5.........EPS: 3.92

year 6.........EPS: 4.43

year 7.........EPS: 5.01

year 8.........EPS: 5.66

year 9.........EPS: 6.4

year 10........EPS: 7.23

Estimated price a decade from now given past growth rate: $181

The estimated annual rate of return (no dividends) compounded is 11.8%

International Business Machines Corp. (Public, NYSE:IBM)

year 1.........EPS: 11.65

year 2.........EPS: 13.98

year 3.........EPS: 16.78

year 4.........EPS: 20.13

year 5.........EPS: 24.16

year 6.........EPS: 28.99

year 7.........EPS: 34.79

year 8.........EPS: 41.75

year 9.........EPS: 50.1

year 10........EPS: 60.12

Estimated price a decade from now given past growth rate: $782

The estimated annual rate of return (no dividends) compounded is 19.8%

Remember now, these are just estimates, and by no means should you go out and buy a stock just because it's supposed to have a good rate of return. In fact, I can say with a fair ammount of certainty, that IBM will not be able to keep up it's pace over the next decade. The last bubble and recession skewed the data slightly, and don't even TRY to estimate the rate of return for banks like BAC and Citi. Nor should you trust it's results for new faces like Apple Inc. (Public, NASDAQ:AAPL), or Google Inc. (Public, NASDAQ:GOOG), as you'll get ridiculous growth rates.

All that being said, a prudent investor should always try and make their decisions devoid of emotion. This is a nice little screen if you want to invest LONG TERM in WELL KNOWN, LARGE CAP companies.

Remember to use diligence on all your picks. Comment or find me on twitter ("SambaStocks") if you want to request that I post any other results. I'll also post more periodically.

Good Luck,

Samba

I'd been doing the calculation the old fashioned way, and finally decided to expedite the proecess with a program. Generally, we like stocks that can give us above a 14% annual compounded rate of return not including dividends. Here are some of the results:

Microsoft Corporation (Public, NASDAQ:MSFT)

year 1.........EPS: 1.74

year 2.........EPS: 1.97

year 3.........EPS: 2.22

year 4.........EPS: 2.51

year 5.........EPS: 2.84

year 6.........EPS: 3.21

year 7.........EPS: 3.62

year 8.........EPS: 4.09

year 9.........EPS: 4.63

year 10........EPS: 5.23

Estimated price a decade from now given past growth rate: $102

The estimated annual rate of return (no dividends) compounded is 13.0%

Nordstrom, Inc. (Public, NYSE:JWN)

year 1.........EPS: 1.81

year 2.........EPS: 2.12

year 3.........EPS: 2.48

year 4.........EPS: 2.9

year 5.........EPS: 3.4

year 6.........EPS: 3.98

year 7.........EPS: 4.65

year 8.........EPS: 5.44

year 9.........EPS: 6.37

year 10........EPS: 7.45

Estimated price a decade from now given past growth rate: $156

The estimated annual rate of return (no dividends) compounded is 16.2%

The Coca-Cola Company (Public, NYSE:KO)

year 1.........EPS: 2.97

year 2.........EPS: 3.27

year 3.........EPS: 3.59

year 4.........EPS: 3.95

year 5.........EPS: 4.35

year 6.........EPS: 4.78

year 7.........EPS: 5.26

year 8.........EPS: 5.79

year 9.........EPS: 6.37

year 10........EPS: 7.0

Estimated price a decade from now given past growth rate: $119

The estimated annual rate of return (no dividends) compounded is 7.7%

Caterpillar Inc. (Public, NYSE:CAT)

year 1.........EPS: 2.41

year 2.........EPS: 2.72

year 3.........EPS: 3.07

year 4.........EPS: 3.47

year 5.........EPS: 3.92

year 6.........EPS: 4.43

year 7.........EPS: 5.01

year 8.........EPS: 5.66

year 9.........EPS: 6.4

year 10........EPS: 7.23

Estimated price a decade from now given past growth rate: $181

The estimated annual rate of return (no dividends) compounded is 11.8%

International Business Machines Corp. (Public, NYSE:IBM)

year 1.........EPS: 11.65

year 2.........EPS: 13.98

year 3.........EPS: 16.78

year 4.........EPS: 20.13

year 5.........EPS: 24.16

year 6.........EPS: 28.99

year 7.........EPS: 34.79

year 8.........EPS: 41.75

year 9.........EPS: 50.1

year 10........EPS: 60.12

Estimated price a decade from now given past growth rate: $782

The estimated annual rate of return (no dividends) compounded is 19.8%

Remember now, these are just estimates, and by no means should you go out and buy a stock just because it's supposed to have a good rate of return. In fact, I can say with a fair ammount of certainty, that IBM will not be able to keep up it's pace over the next decade. The last bubble and recession skewed the data slightly, and don't even TRY to estimate the rate of return for banks like BAC and Citi. Nor should you trust it's results for new faces like Apple Inc. (Public, NASDAQ:AAPL), or Google Inc. (Public, NASDAQ:GOOG), as you'll get ridiculous growth rates.

All that being said, a prudent investor should always try and make their decisions devoid of emotion. This is a nice little screen if you want to invest LONG TERM in WELL KNOWN, LARGE CAP companies.

Remember to use diligence on all your picks. Comment or find me on twitter ("SambaStocks") if you want to request that I post any other results. I'll also post more periodically.

Good Luck,

Samba

Labels:

buying stocks,

CAT,

eps,

growth rate,

IBM,

JWN,

KO,

Market Strategy,

MSFT,

picks,

Stock predictions,

stocks

Friday, November 13, 2009

This Week in Retrospect, Next Week's Strategy.

Man what a strange week. I've made some good calls and some bad. I bought Ford Motor Company (Public, NYSE:F) all the way down into earnings, and I feel pretty good about that. However, I got scared when I saw that growth slope and sold WAY to early. On the other hand, I sold Nordstrom, Inc. (Public, NYSE:JWN) almost perfectly at it's peak, and I've been shorting down since then. I started out very bullish on Puda Coal, Inc (Public, AMEX:PUDA), and I am just getting BURNED by that buy. Of course to make matters worse, they come out with an earnings statement that basically shows all good news except this quarter's EPS. Saying things like "Puda Coal received final approval from the Shanxi provincial government to consolidate 8 coal mines in Pinglu County." And I hear about China's increasing demand for steel and therefore coking coal. And even still, the price goes down. I like to think I can keep my emotions at bay, but PUDA still feels like a very strong buy. Worse, I DROOL when I see pullbacks, and it just makes doubling down on the stock that much more tantalizing.

Sometimes I just don't understand Wall St. But, as a technical trader, what I do know is this: We are in a crucial time for the market. The S&P is hitting MAJOR resistance at 1100, and at the same time, we're hearing all this talk about various funds having to pour money into stocks because they've missed the move so far.

Now I consider myself a bull, but these secondary market fluctuations are based so much on psychology. I think the market is getting ahead of itself, and if I think that, imagine how bears view the market. I'm going to have to stick to my charts. I'm maintaining my S&P prediction of 1115. But after that, I expect it to drop over the course of a couple months to around 1000. I've illustrated this pattern of testing macro resistance, correcting downward, and blasting through resistance in my previous posts. Take a look if you're a visual kind of person :). Therefore, I'm playing mostly conservatively for the next month or so. When the S&P reaches my target, or when it starts to show signs of a reversal, I am shorting the market using ProShares Short S&P500 (ETF) (Public, NYSE:SH). Still going to hold on to my long term positions that were left over from panic recession mode, PepsiCo, Inc. (Public, NYSE:PEP), and SPDR Gold Trust (ETF) (Public, NYSE:GLD) being the largest. And mark my words I AM DOUBLING DOWN ON PUDA COAL. This is a company I really believe in. I think it has AMAZING growth potential. I still don't know if it will pan out, but I am confident enough to sleep at night. The risk is limited because of the low price of the stock and the fact that it's a Chinese company that mainly sells domestically to Chinese buyers. I think it's going to post monster numbers after it finishes consolidating the 8 coal mines.

Good Luck,

-Samba

Sometimes I just don't understand Wall St. But, as a technical trader, what I do know is this: We are in a crucial time for the market. The S&P is hitting MAJOR resistance at 1100, and at the same time, we're hearing all this talk about various funds having to pour money into stocks because they've missed the move so far.

Now I consider myself a bull, but these secondary market fluctuations are based so much on psychology. I think the market is getting ahead of itself, and if I think that, imagine how bears view the market. I'm going to have to stick to my charts. I'm maintaining my S&P prediction of 1115. But after that, I expect it to drop over the course of a couple months to around 1000. I've illustrated this pattern of testing macro resistance, correcting downward, and blasting through resistance in my previous posts. Take a look if you're a visual kind of person :). Therefore, I'm playing mostly conservatively for the next month or so. When the S&P reaches my target, or when it starts to show signs of a reversal, I am shorting the market using ProShares Short S&P500 (ETF) (Public, NYSE:SH). Still going to hold on to my long term positions that were left over from panic recession mode, PepsiCo, Inc. (Public, NYSE:PEP), and SPDR Gold Trust (ETF) (Public, NYSE:GLD) being the largest. And mark my words I AM DOUBLING DOWN ON PUDA COAL. This is a company I really believe in. I think it has AMAZING growth potential. I still don't know if it will pan out, but I am confident enough to sleep at night. The risk is limited because of the low price of the stock and the fact that it's a Chinese company that mainly sells domestically to Chinese buyers. I think it's going to post monster numbers after it finishes consolidating the 8 coal mines.

Good Luck,

-Samba

Thursday, November 12, 2009

Next up: Correction

We're going to be going through some tough times very soon (for reasons listed in my previous post ). If you're like me, you're licking your lips right now. You gotta love market corrections. All those panicing investors frantically selling off their positions; hoarding cash like squirrels. Once again I want to look at my favorite stock of late: Nordstrom, Inc. (Public, NYSE:JWN).

I was forced to sell my position and short this morning based on Macy's earnings and JWN's technicals. I still think it's a great company, but the risk was too high to own it into earnings, because even if the earnings are good, the stock is near a peak, and there's only so much that investors will are willing to pay for a stock (even a good one).

Whether we bulls like it or not, this market is ahead of itself. It's due for a correction. But my position is this: We are still in recovery mode. The economy will continue to get better, but not as fast as the market would like you to believe. Therefore, after the market retracts to it's macro support level that I illustrated in chart, we cover our shorts, and buy value stocks. When this happens, I like Ford Motor Company (Public, NYSE:F) (which I pre-emtively and mistakenly sold and shorted a couple days ago.However, it resiliantly kept gaining until today). Again, I like Nordstrom after the pull back. Also, look to techs and financials; I like The Blackstone Group L.P. (Public, NYSE:BX) to beat a market comeback and Brocade Communications Systems, Inc. (Public, NASDAQ:BRCD).

These are of course, looking a few weeks into the future. Until then, I'm short the market and looking for signs to cover. Remember that being short is just a bonus. You are facing ULIMITED RISK, so be ready to take any profits.

Warren Buffet likes to hold stocks forever and play value stocks' growth trend as stated in general Dow theory. Small timers like myself like to play the same trend, but I like to also play the secondary movements. The reason being, if a stock is worth 10 and it goes up to 11 then down to 10 then up to 12 you gain 20%. If you were to sell at 11 then re buy at 10 and sell at 12, you gain 30%. Shorting some of the way down is as I said a bonus (if the downturn is easy to predict like JWN and the market in general right now). When you're playing with stocks you like, it's not good to bet against them for too long.

Take my opinions as you will.

Good Luck,

-Samba

I was forced to sell my position and short this morning based on Macy's earnings and JWN's technicals. I still think it's a great company, but the risk was too high to own it into earnings, because even if the earnings are good, the stock is near a peak, and there's only so much that investors will are willing to pay for a stock (even a good one).

Whether we bulls like it or not, this market is ahead of itself. It's due for a correction. But my position is this: We are still in recovery mode. The economy will continue to get better, but not as fast as the market would like you to believe. Therefore, after the market retracts to it's macro support level that I illustrated in chart, we cover our shorts, and buy value stocks. When this happens, I like Ford Motor Company (Public, NYSE:F) (which I pre-emtively and mistakenly sold and shorted a couple days ago.However, it resiliantly kept gaining until today). Again, I like Nordstrom after the pull back. Also, look to techs and financials; I like The Blackstone Group L.P. (Public, NYSE:BX) to beat a market comeback and Brocade Communications Systems, Inc. (Public, NASDAQ:BRCD).

These are of course, looking a few weeks into the future. Until then, I'm short the market and looking for signs to cover. Remember that being short is just a bonus. You are facing ULIMITED RISK, so be ready to take any profits.

Warren Buffet likes to hold stocks forever and play value stocks' growth trend as stated in general Dow theory. Small timers like myself like to play the same trend, but I like to also play the secondary movements. The reason being, if a stock is worth 10 and it goes up to 11 then down to 10 then up to 12 you gain 20%. If you were to sell at 11 then re buy at 10 and sell at 12, you gain 30%. Shorting some of the way down is as I said a bonus (if the downturn is easy to predict like JWN and the market in general right now). When you're playing with stocks you like, it's not good to bet against them for too long.

Take my opinions as you will.

Good Luck,

-Samba

Tuesday, November 10, 2009

S&P 500 1100 is a Foregone Conclusion. Then Comes the Correction.

Forget what the pundits saying. These guys don't have the capacity to take a step back and look at the long term trends of the market. They're too focused on "breaking news" that almost always has a short and unsustainable effect of stock prices. To beat the market, we have to look at long term trends that we can play. We have to anticipate market moves. The only way to do that is to look at long term patterns.

If we do take a step back and look at the S&P 500 we see a very strong bullish chart for week.

We can see that about a week into every rally in the past three months, there has been a short market breather before increased gains. We have hit that stall. Wait a couple days, and the S&P will be back in the green. As the resistance trend shows, it will top 1,100 test at around 1,115. That's when we should get very bearish. The obvious reason being that the 500 have consistently tested that resistance line, and the index has consistently failed.

Let's zoom out.

There is no reason to expect the S&P to break resistance at 1,100 for more that a very short time. We have seen in the past, that when faced with a macro resistance level, the S&P first corrects downward (circled), and then snaps back up and through the resistance line. If, after the current rally, the S&P fails to bounce off the support I illustrated in the 3 month chart, I would make the call to stay short and wait for the correction.

Good Luck,

Samba

If we do take a step back and look at the S&P 500 we see a very strong bullish chart for week.

We can see that about a week into every rally in the past three months, there has been a short market breather before increased gains. We have hit that stall. Wait a couple days, and the S&P will be back in the green. As the resistance trend shows, it will top 1,100 test at around 1,115. That's when we should get very bearish. The obvious reason being that the 500 have consistently tested that resistance line, and the index has consistently failed.

Let's zoom out.

There is no reason to expect the S&P to break resistance at 1,100 for more that a very short time. We have seen in the past, that when faced with a macro resistance level, the S&P first corrects downward (circled), and then snaps back up and through the resistance line. If, after the current rally, the S&P fails to bounce off the support I illustrated in the 3 month chart, I would make the call to stay short and wait for the correction.

Good Luck,

Samba

Subscribe to:

Posts (Atom)