Happy Holidays everybody!

First of all, if you were directed here from twitter, I want to let you know that I try my very best to read your tweets. You post a lot (A LOT!) of great information and news (you're where I'd say I get about 40% of my news.) , and I DO appreciate your dedication and I hope you find my posts as interesting as I find yours.

Today I want to share my thoughts on where we will be a year from now (in the vein of Doug Kass):

Increased regulation will stifle earnings growth for financials, and their stocks will be reduced to dividend paying, lending utilities.

Dollar value fluctuates but ultimately ends up around where it is today.

Ford Motors will emerge as the dominant automotive company in the US.

Interest rates rise earlier than expected.

Jobs recover! (maybe wishful thinking, but hey! it's the holidays!)

Afghanistan will be a mess.

Crude will cost $90 per barrel.

25% of movies are in 3D, making the theaters more fasionable again.

New home sales do not recover at a sufficient pace.

Provided we're in the right place, we'll have another great year in the market.

I'm willing to defend my positions! ;) and I'm always ready to hear other opinions.

What do you think? How full is the glass for you next year?

Comment or email me at sambarad@gmail.com

-Samba

Note: Starting next year, I will be posting my top 3 positions, my analysis, and any changes.

Wednesday, December 23, 2009

Wednesday, December 9, 2009

Selling Puts to Acquire Stock

Have you ever found yourself saying, "Man I would pick that stock up in an instant, if only it was just a couple points lower." We know that small differences in price can greatly impact your compounded earnings over the course of years. We should always buy stocks at the prices that we dictate. Long term limit orders are the most commonly used way to acquire stock at the price we want (and I hope you use limit orders for EVERY trade you make).

I want to talk about another widely used conservative strategy; that is, the use of puts to buy stock. When you sell a put, you are essentially agreeing to buy 100 shares of a specified stock at a specified price (usually, and for this meathod always, below its current price). You keep the premium you get for selling the option no matter what. Keep in mind, that's the max amount you can recieve. If the underlying goes up a hundred points, you still only keep whatever you got for the premium. On the other hand, you are liable to participate in substantial losses, should the stock price decrease substantially. This however, is the same risk you accept if you were to buy the stock any other way, except that you are protected somewhat by the option premium that you recieved when you sold the put.

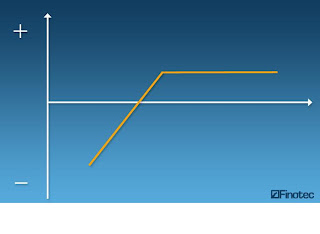

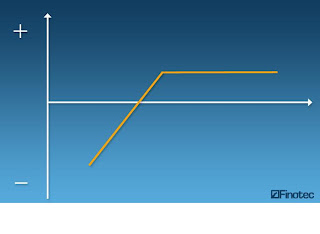

Here we see profits and losses on the y-axis and stock prices ascending from left to right on the x-axis.

There are many advantages to this strategy over the use of limit orders. First and foremost, if the stock does go up or remain flat, you keep the premium. A limit order gets you nothing. Second, put options have expiration dates, which means you can have a better idea of when you will need the cash if and when you have to buy the stock. After all, anything can happen. If your limit order gets touched, you better have the cash ready. With a put, even if it gets to the strike price before expiration, there's no guarantee the puts will be exercised, and you will generally have days to muster up the cash because put buyers don't make a profit until the stock goes below the strike price. Usually, you only have to keep 20% of the strike price in cash to satisfy your brokerage. With limit orders, it's good to have 100% of the cash ready (so you don't unexpectedly go on margin), although that is by no means a requirement.

When implementing this strategy just remember that you are intending to buy a depreciated security. If you're selling puts just to increase cash flow, you better be absolutely certain that that thing isn't going to get exercised. Make sure that you are comfortable owning a stock that has depreciated. Remember that premiums are adjusted for volatility. More volatile stocks have higher premiums, and therefore a higher risk of painful depreciation. Also, remember that there was a reason you wanted to buy the stock lower for a reason. if the stock goes up, let it -unless the company has fundamentally changed.

If things are going REALLY badly, maybe on unexpected news, you can always close out your position, buy buying back your put.

I feel this strategy is best used in portfolios seeking income. If you want a certain dividend yield, and are waiting for the stock price to drop so you can get that yield, this is a perfect strategy to acquire income in the meantime. Dividend stocks generally have lower volatility and therefore have lower premiums, but if your objective is income, the lower premiums should still fulfill your objectives.

Good Luck,

-Samba

I want to talk about another widely used conservative strategy; that is, the use of puts to buy stock. When you sell a put, you are essentially agreeing to buy 100 shares of a specified stock at a specified price (usually, and for this meathod always, below its current price). You keep the premium you get for selling the option no matter what. Keep in mind, that's the max amount you can recieve. If the underlying goes up a hundred points, you still only keep whatever you got for the premium. On the other hand, you are liable to participate in substantial losses, should the stock price decrease substantially. This however, is the same risk you accept if you were to buy the stock any other way, except that you are protected somewhat by the option premium that you recieved when you sold the put.

Here we see profits and losses on the y-axis and stock prices ascending from left to right on the x-axis.

There are many advantages to this strategy over the use of limit orders. First and foremost, if the stock does go up or remain flat, you keep the premium. A limit order gets you nothing. Second, put options have expiration dates, which means you can have a better idea of when you will need the cash if and when you have to buy the stock. After all, anything can happen. If your limit order gets touched, you better have the cash ready. With a put, even if it gets to the strike price before expiration, there's no guarantee the puts will be exercised, and you will generally have days to muster up the cash because put buyers don't make a profit until the stock goes below the strike price. Usually, you only have to keep 20% of the strike price in cash to satisfy your brokerage. With limit orders, it's good to have 100% of the cash ready (so you don't unexpectedly go on margin), although that is by no means a requirement.

When implementing this strategy just remember that you are intending to buy a depreciated security. If you're selling puts just to increase cash flow, you better be absolutely certain that that thing isn't going to get exercised. Make sure that you are comfortable owning a stock that has depreciated. Remember that premiums are adjusted for volatility. More volatile stocks have higher premiums, and therefore a higher risk of painful depreciation. Also, remember that there was a reason you wanted to buy the stock lower for a reason. if the stock goes up, let it -unless the company has fundamentally changed.

If things are going REALLY badly, maybe on unexpected news, you can always close out your position, buy buying back your put.

I feel this strategy is best used in portfolios seeking income. If you want a certain dividend yield, and are waiting for the stock price to drop so you can get that yield, this is a perfect strategy to acquire income in the meantime. Dividend stocks generally have lower volatility and therefore have lower premiums, but if your objective is income, the lower premiums should still fulfill your objectives.

Good Luck,

-Samba

Wednesday, December 2, 2009

Bullish on Boeing

Hello hello. I want to take a closer look at the technicals for The Boeing Company (Public, NYSE:BA). I think that the fundamentals have finally justified what the technicals are telling me. Boeing has historically been a good play durring war time, and with Obama committing another 30,000 troops to Afghanistan, it looks like we're going to be there for a while. Also, there is always that 787 Dreamliner to look forward to, which is Boeings highly anticipated new plane model. With each set back and delay, the price of the stock goes down. It would be good to note however, that the stock has been reacting less and less with each delay. Let's look at the chart.

We can see a clear ascending accumulation triangle (which shouldn't be confused with the bearish ascending wedge pattern which is usually followed by a reversal). Recently, the stock price experienced an almost EXACTLY 10% measured move downward. Again, this usually marks a strong bullish upward continuation of the primary trend. I've been following this stock for a while, but the fundamentals never made it appealing enough. With the new troop surge, and a chart that screams buy, I have to recommend that you take a good look at Boeing.

Good Luck,

Samba

We can see a clear ascending accumulation triangle (which shouldn't be confused with the bearish ascending wedge pattern which is usually followed by a reversal). Recently, the stock price experienced an almost EXACTLY 10% measured move downward. Again, this usually marks a strong bullish upward continuation of the primary trend. I've been following this stock for a while, but the fundamentals never made it appealing enough. With the new troop surge, and a chart that screams buy, I have to recommend that you take a good look at Boeing.

Good Luck,

Samba

Subscribe to:

Posts (Atom)