Hey everyone. I hope you all had a great new year! I was finally able to complete my 2010 long term holdings portfolio, and as promised, I will be chronicling its performance, along with any short term trades I make. But I'll get to that later.

First, I want to talk about my theories on the aftermath of the crash, and the performance of the Fed and the government stimulus. I think that the crash was healthy. There is a widespread and popular attitude change geared toward saving, and individual fiscal responsibility. The economy is now rightfully in the forefront of the public's collective mind. Weak companies have been mostly weeded out, and personally, I feel a new patriotism because of the resilience I see in our American economy.

The Fed acted late as usual, but the rate cuts have been largely successful in avoiding a depression. The government has been bogged down by its bureaucracy, but the stimulus has been somewhat successful. Cash for clunkers didn't steal future demand from auto makers, but rather gave them a fighting chance to improve and revamp their business models. TARP will be profitable, and the sustained liquidity it provided, has kept credit available (for the most part). On the other hand, the new home buyers' tax credit has been a bust, and as we saw today, new housing demand has remained low.

This brings me to my next point. When a bubble bursts - let it. When the tech bubble burst, you didn't see the government bailing out dot coms, or incentivising the purchase of internet products. People within the sector were hit hard, but the greater economy barely blinked. When the stock market crashed in 1929 (effectively a stock bubble crash), the government didn't try to stimulate demand for stocks. Instead, FDR's stimulus worked to maintain bank liquidity and create jobs, thus attempting to limit collateral damage from the crash. With the "housing bubble" then - why is the government rewarding the cause of the crash? The government is now propping up demand for houses. How can they expect to keep demand at bubble levels?

Proponents of laissez faire economic schools contest that we should have let the ENTIRE economy reset. That would have been a terrible mistake. Great companies wouldn't have had a chance to recover, and the resulting credit freeze would have crippled ALL industries (even those not directly effected by the housing bubble).

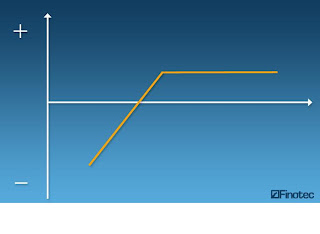

I do believe however, that the housing market should be allowed to reset. Demand could at least come close to some kind of equilibrium. Trying to prop up a bubble is impossible, and a waste of time and money. The housing industry should be allowed to implode. House prices should be allowed to go down until people are willing to buy them. Cheap houses will be swooped up, and supply supply will decrease sufficiently. Only then can growth can continue.

If hypothetically, there was a new gold bubble that popped. We can agree that Miners shouldn't be bailed out. Any fallout should be addressed so that the larger economy can continue, but the bubble demand for gold shouldn't be propped up.

The Fed and government have largely done a good job so far. However, the new home buyer tax credit, is just a futile attempt to prop up a bubble, priming another downturn. We can, should, and will learn from this mistake. What do you think?

-Samba

Here is my portfolio of long term 2010 holdings:

The theme is growth and/or dividend income with companies having great management, and great position for continued growth in sectors not closely tied to the prices of any commodities. In 2009 we found that the winners were stocks that had clear objectives and great adaptability. Able to use the downturn to their advantage, these companies put themselves in the best position for continued growth. While most stocks "worked" in 2009 (as quarter over quarter growth was easy), strong management has and will, prime these companies for a long term (2-5 years) upward trajectory based on market share, ROE and EPS growth year over year. This is the core of my personal portfolio.

Google Inc. (Public, NASDAQ:GOOG)

Ford Motor Co. (DE) PRFD 'A' (Public, NYSE:F-A)

Teekay LNG Partners L.P. (Public, NYSE:TGP)

Activision Blizzard, Inc. (Public, NASDAQ:ATVI)

Discovery Communications Inc. (Public, NASDAQ:DISCA)

The Boeing Company (Public, NYSE:BA)

I will keep you posted, and write my analysis on each stock. And please keep me posted... I enjoy all your tweets, and I try and read as much of what you post as I can.